quicken tax planner problem

Choose Export Data To tax export file. You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth.

Quicken Archives Money Musings Moneymusings Com

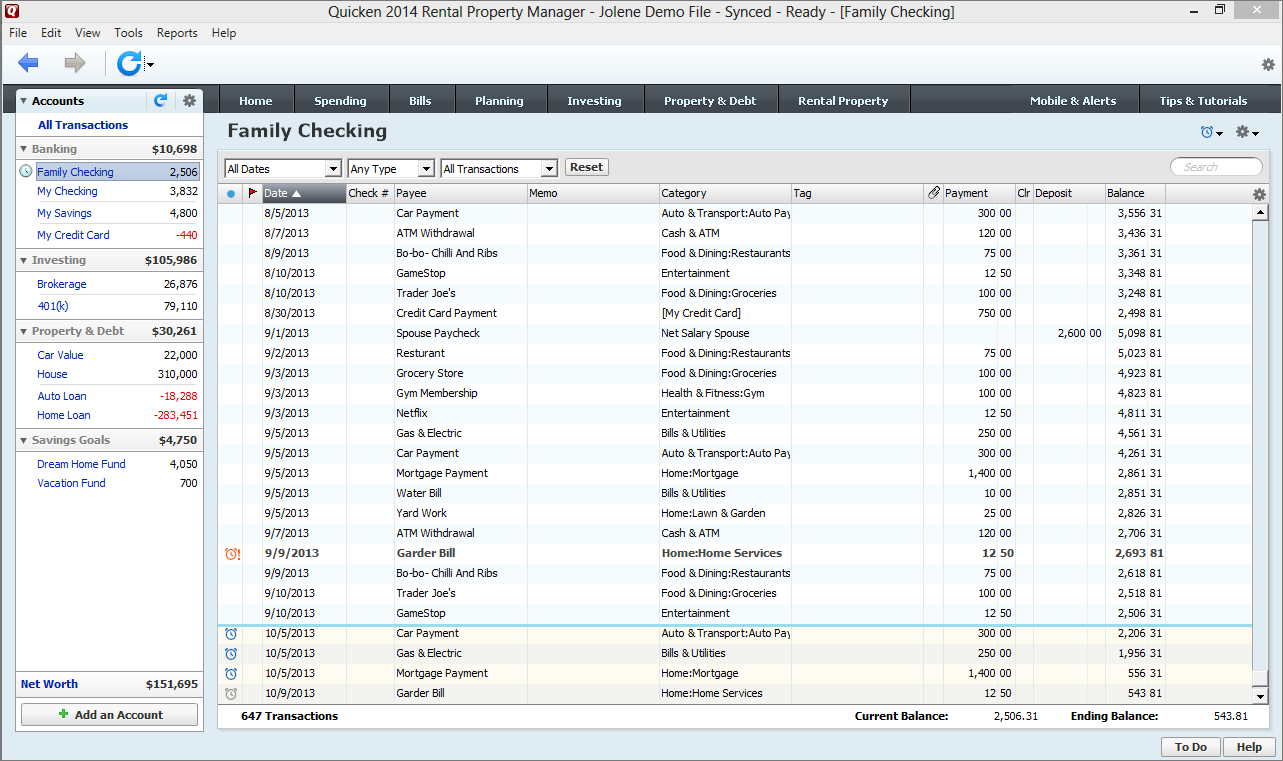

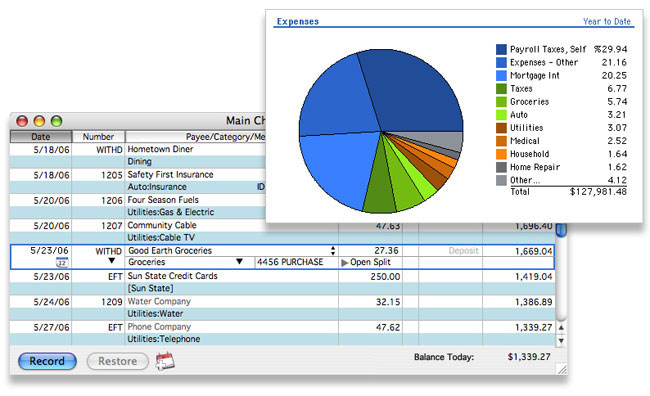

Quickens robust financial planning tool includes several options such as budgeting tax planning and long-term planning.

. There appear to be two problems. In August 2020 Quicken moved from a Bill Pay platform to a new platform called Quicken Bill Manager. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

In the Save in field select a location for the file. Tax Planner Issues. Because the US.

I dug into the budgeting tool with. Quicken also offers a Tax Center. Choose the tax planner command.

1099-Misc- Used to report miscellaneous income received and direct sales of consumer goods for resale. It is common for some problems to be reported throughout the day. On May 2 my old problem returned - same two tax fields same repeatable behavior.

30-day money back guarantee. To get the most accurate estimate of your taxes you might decide to fine-tune the values in the Tax Planner. The problem disappeared it now appears to be running properly once again.

The Tax Center includes the option to all the information you need to file your taxes including how to report income and expenses what deductions you can claim and more. If youre not satisfied return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less. If you didnt do that its okay.

The tax schedule line items Quicken uses include these forms and schedules. And set up reminders so the Tax Planner is correct 0. Downdetector only reports an incident when the number of problem reports is significantly higher than.

1099-G - Used to report certain government payments from federal state or local governments. In Investing Windows How do I enter Thrift Savings Plan monthly RMDs into Quicken to correctly report the income and federal tax withheld. This morning May 4 I opened Quicken saw that the Tax Planner problem was present and I immediately ran Super-Validate.

If youre able to open Quicken but youre not able to get into your file because of problems signing in with your Quicken ID you can find help for that by clicking here. In the file name field enter a name for the file and click save. I use Quicken Premier and Im on release 2314.

Youll find it below the. The tax planner can use your quicken data to. It is my Social Security Paycheck tracking reminder that is not projected properly in the Tax Planner.

Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity. If you use a different tax preparation software package or do your taxes by hand you can use the mileage records in the Vehicle Mileage Tracker to help you enter your mileage on your. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of the form seems to be.

Wayne Daren Member. There is no end date option in the Paycheck tracker reminder. Refer to the manufacturers instructions for your tax software for information about how to import the TXF file that was created.

Click the Add Paycheck button. Quicken billing. Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations.

In the File name field enter a name for the file and click Save. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

An issue where the new status blue icon of a transaction was not cleared after the transaction was edited. An issue where a subscription alert message could still display immediately after the subscription was renewed due to a timing problem with alerts. If you use that versions Tax Planner in 2022 Quicken displays your current.

Specifically its not saving Scheduled Bills and Deposits under Other Income or Losses Its also not saving Scheduled Bills and Deposits under Withholdings. Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity. TurboTax Online no longer supports Quicken import.

If youre not satisfied return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less. They both complete all the needs of the users. Click the Planning tab and then click the Tax Center button.

The current year and the year prior. Quicken can help you adjust your year-to-date totals using the Paycheck wizard. Quicken tax planner problem.

If you use TurboTax you can import your mileage from Quicken directly into TurboTax. Overview If youre unable to open Quicken for Windows after a recent product update its possible that an issue during the installation is preventing Quicken from opening. Any tax planner data fields for which no quicken data is available are reset to zero.

This chart shows a view of problem reports submitted in the past 24 hours compared to the typical volume of reports by time of day. Yet this has existed in every version after quicken 2007 was released. For example the Subscription Release of Quicken is currently in 2022 so its Tax Planner supports calculations for tax years 2022 and 2021.

For some reason I cannot get the Tax Planner to save certain settings. 30-day money back guarantee. Quicken outages reported in the last 24 hours.

1099-R- Used to report taxable and nontaxable retirement. TurboTax will import both the mileage and the tax-deductible dollar amounts. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of.

The Tax Planner doesnt account for the fact that taxes are only due on 85 of the Social Security benefit. Updated the W4 tax rates and mileage rates in the Tax Planner.

Another Tax Planner Issue Question With Wages Quicken

Tax Planner Other Withholding Using Wrong Total Quicken

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Phone Support Accounting Software

Quicken 2010 Review Moneyspot Org

5 Investment Ideas Outside Of The Stock Market In 2021 Investing In Stocks Investing Creating Passive Income

Quicken Starter Review Top Ten Reviews

Quicken For Mac 2016 Review Un Kill Bill Pay

Tax Planner Other Income Using Wrong Total Quicken

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 Accounting Software Financial Information Business Support

![]()

Quicken Review 2022 Pricing Features Complaints

Quicken For Mac 2016 Review Un Kill Bill Pay

Quicken Data File Extension Get Instant Support To Open It

401k Scheduled Deductions In Tax Planner Quicken

Quicken 2018 For Mac A Long Time User Review Robert Breen

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits